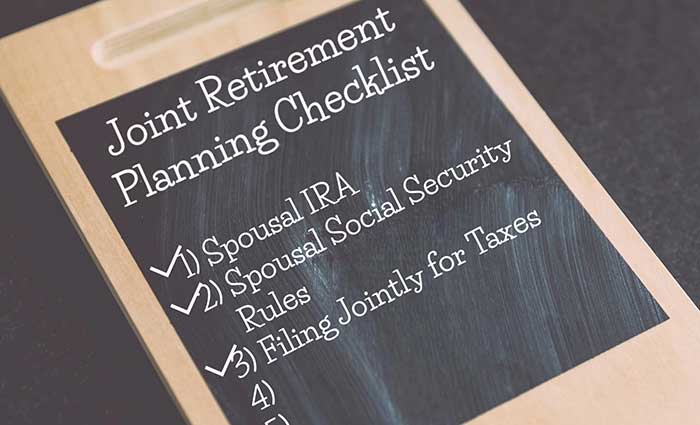

Preparing and planning for unexpected costs in retirement is an essential step in ensuring financial security and peace of mind. Here is a checklist of steps to take to help you prepare for unexpected costs in retirement:

- Spousal IRA: Consider establishing a spousal IRA for the non-working spouse, allowing them to save for retirement even without an income. This can be a traditional or Roth IRA, with contribution limits set by the IRS each year.

- Spousal Social Security Rules: Coordinate your benefits with your spouse’s benefits to maximize your Social Security payments. Consider strategies like the “split strategy” or filing a restricted application for spousal benefits only, based on the younger spouse’s earnings record.

- Filing Jointly for Taxes: Pros – potentially lower tax rates, higher deductions, and more tax credits. Cons – joint liability for any tax debts or penalties, and potential exposure to the Marriage Tax Penalty.

- Two-Income Household Financial Tips: Create a budget to track expenses, prioritize saving and investing, diversify income streams, and be mindful of tax implications when making financial decisions.

- One-Income Household Financial Tips: Focus on reducing expenses, building an emergency fund, and making the most of the working spouse’s benefits, such as employer-sponsored retirement plans.

- Remember, You and Your Spouse Are a Team: Communicate openly about finances, set shared financial goals, maintain an emergency fund, and seek professional advice if needed.

By taking these steps to prepare and plan for retirement with your spouse, you can avoid making costly mistakes with your finances and help to maximize your financial situation.

Sources: https://investor.vanguard.com/investor-resources-education/social-security/strategies-for-married-couples, https://www.moneytalksnews.com/slideshows/planning-retirement-as-a-couple/, https://www.investopedia.com/terms/m/mfj.asp