Nov 9, 2023 | Finances, Investing, Retirement Planning, Saving Money, Social Security

Retirement is one of the most significant milestones in life. It represents the culmination of years of hard work and savings, but it also marks the beginning of a new financial chapter. Ensuring a comfortable and stable retirement requires careful planning, and a key...

Nov 6, 2023 | Finances, Investing, Saving Money, Taxes

As the final quarter of the year approaches, investors are faced with a unique set of opportunities and challenges. The fourth quarter, often marked by increased market volatility and potential year-end considerations, requires a well-thought-out investment strategy....

Oct 18, 2023 | Finances, Investing, Saving Money

Tips for this Season of Preparation and Cultivation With the transformation of the leaves and a cool, refreshing breeze, fall offers more than just Pumpkin Spice everything. It’s an annual opportunity to contemplate your financial aspirations and lay the...

Sep 20, 2023 | Investing, Retirement Planning, Saving Money

Weekly Update – 9/20/23 The concept of wellness is used often, generally when referring to a balanced and fulfilling life overall. But what does it mean when someone refers to their financial wellness? Financial wellness encompasses all aspects of an individual’s...

Jul 13, 2023 | Finances, Investing, Retirement Planning, Saving Money, Social Security

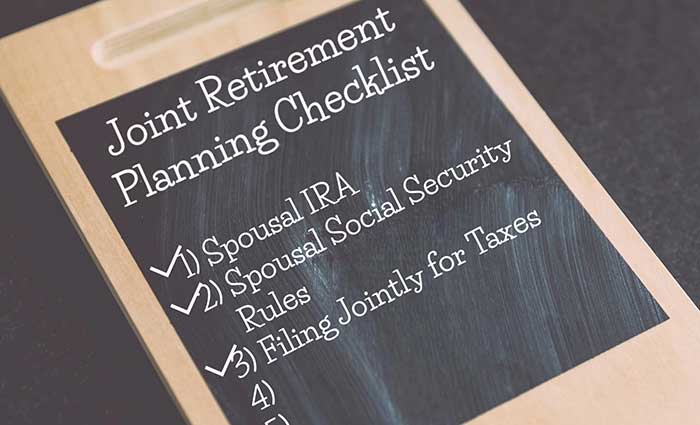

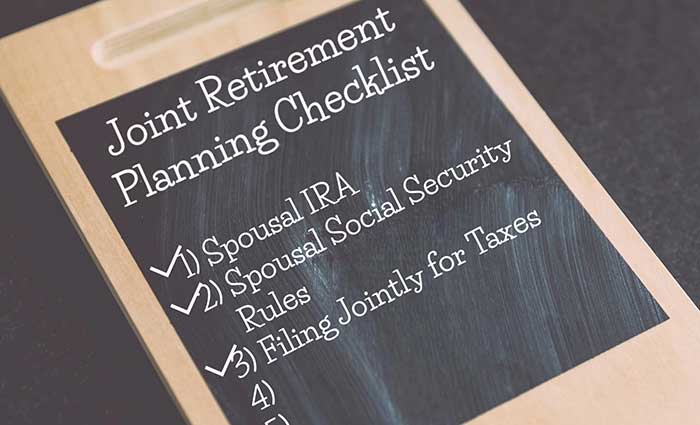

Preparing and planning for unexpected costs in retirement is an essential step in ensuring financial security and peace of mind. Here is a checklist of steps to take to help you prepare for unexpected costs in retirement: Spousal IRA: Consider establishing a spousal...

Jul 13, 2023 | Finances, Investing, Retirement Planning, Saving Money

Weekly Update – 7/12/23 A target-date fund is an investing tool, often in the form of an ETF or mutual fund, that adjusts its investment strategy based on how much time there is until the target date. The investments are strategized for long-term growth when you are...